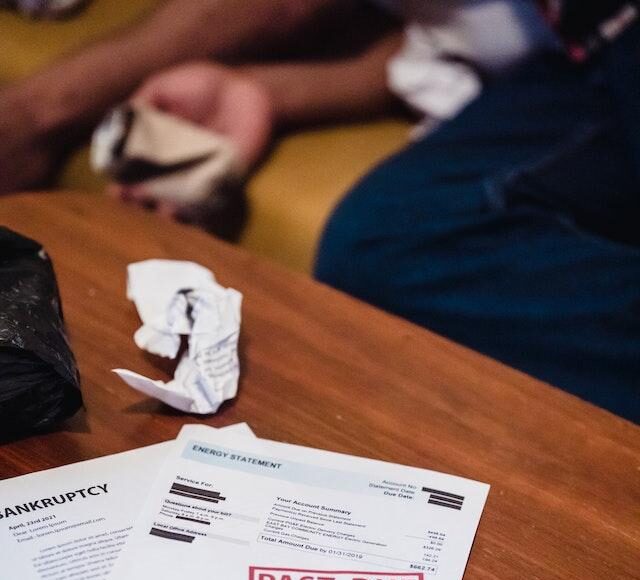

Filing for bankruptcy is a tough decision, and it’s vital to have the right bankruptcy attorney by your side. They’re like your financial GPS, helping you navigate the complex terrain of bankruptcy law. But how do you find the perfect attorney who understands your unique situation?

To give you an idea, here are six practical tips for picking the right bankruptcy attorney.

Table of Contents

Start with Local Options

Begin your search close to home. Local bankruptcy attorney Johnson County KS are familiar with the ins and outs of the local legal system. They know the local courts, the trustees, and the specific rules that apply.

Not to mention, they’re often more accessible for face-to-face meetings. You can find them by searching online, asking friends, or checking out local directories.

Seek Recommendations

Don’t be shy about asking for recommendations. Talk to friends, family, or colleagues who’ve been through bankruptcy. Their personal experiences can lead you to a trustworthy attorney. They can tell you about their interactions with the attorney, how well they communicated, and the overall experience they had. It’s like getting a restaurant recommendation from a friend, you will naturally trust them more because you trust the person who gave you the recommendation.

Check Qualifications and Experience

Bankruptcy law is a beast of its own, and you need an attorney who’s well-versed in it. Ensure the attorney you’re considering is licensed to practice law and specializes in bankruptcy. Ask about their experience – the more years they’ve been at it, the more situations they’ve seen. You want an attorney who’s seen it all and can provide valuable insights into your unique case.

Schedule a Consultation

Meeting the attorney in person is a crucial step. It’s like a first date – you want to see if there’s a connection. During the consultation, discuss your financial situation openly. How well the attorney listens and understands your concerns matters. Pay attention to their communication style. Can they explain things in plain language? Do you feel comfortable talking to them? This meeting should put you at ease and build your confidence in their abilities.

Consider Legal Fees

Bankruptcy already comes with financial worries, so understanding the cost of legal services is important. Be sure to discuss the attorney’s fees and any additional expenses you might incur during the bankruptcy process. Some attorneys offer free initial consultations, while others work on a flat fee basis for bankruptcy cases. It’s like knowing the total bill at a restaurant before ordering. Clarity on costs will help you plan your budget effectively.

Trust Your Gut

Sometimes, it all comes down to how you feel. You have to trust your gut. Bankruptcy is a significant step, and you need an attorney you can rely on. If something doesn’t feel right during the consultation or you have doubts about the attorney’s approach, it’s okay to keep searching. You want to be sure that your attorney has your best interests at heart, and that your working relationship is based on trust and mutual understanding.